September 08, 2023

Discover, Buy, and Sell Fine Art: Q&A with Artsy’s VP of Collector Sales, Jessica Backus

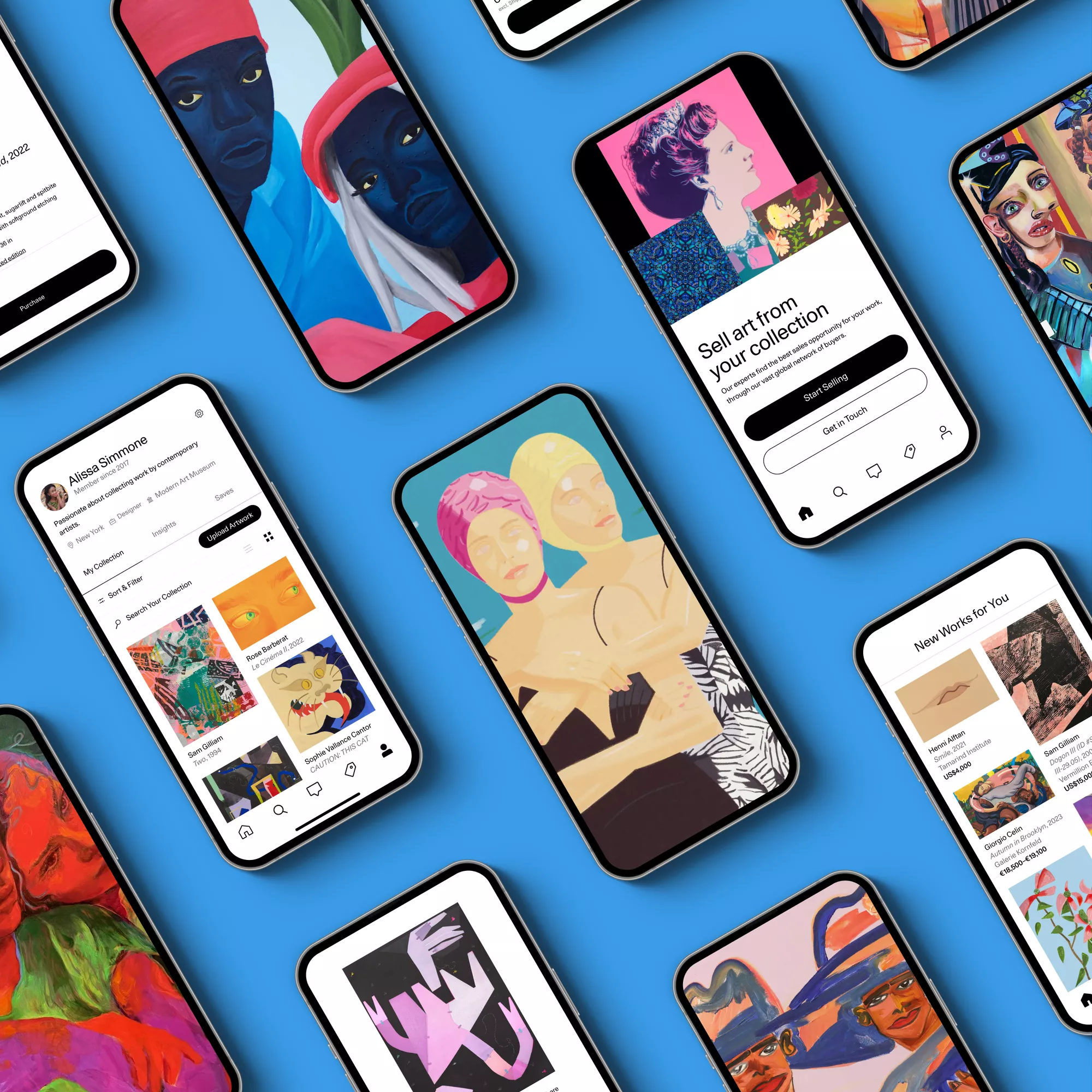

Today, we’re sitting down with Jessica Backus, Vice President of Collector Sales at Artsy, an online marketplace where people can buy and sell art. You can follow Jessica on Twitter @that_j. Art has been bought and sold for thousands of years, but Artsy’s taken this age-old practice to the world of e-commerce, enabling hundreds of smaller, independent artists to drive sales on the platform.

Since its inception in 2009, Artsy has become the leading marketplace to discover, buy, and sell fine art. Can you tell us a little more about Artsy’s business model? What problem is it designed to solve?

If you’re a collector or looking to buy art, the art market is opaque, unwelcoming, and high friction. If you want to resell your art, transaction costs are high, you have to pay to ship your work to a gallery or auction house, and most resellers are specialized in the high-5-figure and up range. We’re trying to change that by bringing the most in-demand art from around the world online, helping people find what they love through superior personalization and expert advisors, and making transactions safe and seamless. We offer various subscription levels for professional sellers and a commission on sales for professional and non-professional sellers alike.

How would you describe the seller community on Artsy?

Artsy works with over 3,200 galleries, auction houses, art fairs, and institutions–and now, increasingly, non-professional sellers– from 100+ countries. Our galleries range from ultra-emerging galleries, like Septieme in Paris or SMAC in Cape Town, to the top galleries in the world, like Gagosian, David Zwirner, or Emmanuel Perrotin. In fact, we just ran an online art fair, Foundations, for emerging galleries on Artsy. For our auctions, we partner with established auction houses and benefit partners– this year, we raised millions of dollars for Amref, Visual AIDS, the Laguna Art Museum, One Acre Fund, and many other causes. Our non-professional sellers are often passionate collectors looking to resell so they can purchase more art.

What’s the competitive landscape look like for selling art? How does Artsy fit into a landscape that includes everything from local art fairs to prestigious auction houses?

You have your traditional players–galleries typically sell primary market works directly from artists’ studios, while dealers and auction houses sell secondary market works. Many galleries also have a secondary market program, often as a way to subsidize their more risky or up-and-coming shows. And increasingly, auction houses are brokering private sales, similar to an art dealer’s business model.

Are there similar art marketplaces online? How does Artsy differentiate itself?

There isn’t an apples-to-apples comparison to Artsy out there. Auction houses are some of the leaders in the market today selling secondary works, like Artsy. But Artsy’s digital supply chain means that we can run secondary market sales at a fraction of the cost of a brick-and-mortar auction house, which means better prices for buyers and better outcomes for sellers. In addition, we also have the primary market on Artsy and partner with other auction houses. As an aggregator, we’re able to fulfill more buyers’ wishlists. We have a highly active, dedicated fine art audience, and we’re ahead of the game regarding technology. For example, we offer one-click check-out, including shipping quotes, for over 26 countries, with a state-of-the-art fraud prevention and payments stack. Finally, to my knowledge, we offer the best buyer and seller guarantees on the market: up to $100,000 per transaction covered for fraud or work not being as described.

We know from our past research that businesses use many different sales channels to reach consumers and sell their products, both online and offline. Do you know how many Artsy sellers also sell online using other channels (e.g., business-owned web stores)? And do you have a sense of how many sell offline, via brick-and-mortar stores or farmer’s markets, for example?

The typical avenues for galleries to sell and reach a new audience are in their own gallery space, their own website, online aggregators, art fairs, and social media and digital marketing. When we surveyed our gallery partners, they reported spending around $80,000 annually on marketing for a gallery with under ten employees and over $400k for a gallery with over 25 employees, with the biggest expenditures being on fairs or events. Art–perhaps not surprisingly–is often an in-person affair.

When we look at recent developments, not surprisingly, many trends in other industries have impacted galleries. Before COVID, an estimated 30-50% of art sales were at art fairs. This plummeted in 2020 and has since rebounded: in 2022 we found that only 1/3rd of galleries were not participating in any fairs, with the median being 1-3. That said, digital sales continue to grow: 38% of galleries saw their online sales grow over the course of 2022. Perhaps one of the most interesting findings from our 2023 trend report was the ways in which young galleries (under 3 years in business) are reaching new clients. First, their buyers skew younger than more established galleries (35-55; art buyers as a group tend to skew older than the general population). What’s most interesting is that twice as many of them (24%) rank Instagram as a significant source of sales.

Some of the trends out there aren’t applicable– for example, I don’t think TikTok is going to be a main driver of art sales (our brilliant head of social, Jordan Huelsenkamp, informs my opinion here). But I think online will continue growing, especially as older millennials enter their prime collecting years.

In the past few years, we’ve seen a rise in single-category online marketplaces, such as Artsy, Back Market, Comic Connect, and Stadium Goods. What do you think is driving this trend? What do you think the future looks like for this type of digital platform?

The first reason is that many large industries are still not served by a one-size-fits-all e-commerce model. Case in point: the art market is a roughly $60 billion annual global market– a market larger than U.S. record sales or sporting events. Many of the biggest e-commerce names have tried to launch art verticals with minimal success because their sites are optimized for selling Playstations and books, what I call a “SKU-model” vs. unique objects.

The second reason is that people see real value in selling things on the secondary market – from concert tickets to $10,000 watches to phones, comics, and art. In the past, your options for resale were basically Craigslist or eBay– these sites were totally unvetted and sold all types of items. The trend towards managed secondary or resale marketplaces is only going to continue.

Back to the question of specialized marketplaces–while most of the new crop of secondary or resale marketplaces–think, the RealReal, 1stDibs, Chrono24, and Artsy–are eCommerce heavy, the devil is in the details when it comes to everything from site navigation, merchandising, and curatorial, payments, the level of discretion needed for a given listing, and the level of white

glove service required. Not to mention the challenge of trust: for the RealReal, they authenticate every item; for Chrono24, they hold funds in Escrow until a buyer has received their item. At Artsy, we partner with the most trusted sellers in the business, and for our secondary markets, we vet every seller and artwork.

Finally, brand and buyer loyalty look totally different in each category. At Artsy, for example, we’ve compiled a database of artist insights – like auction records, exhibition history, and representation–to help people understand the market context and works they might be considering purchasing. And our annual Vanguard feature is a highly anticipated pacesetter for the industry. Many artists featured in the Vanguard, like Tyler Mitchell and Jordan Nassar, have gone on to achieve major career milestones. I don’t think we will see eBay doing something like that.

I’m not sure I can speak to the future of e-commerce for each of these categories. I can say that as trust in secondary markets increases, it sends a strong signal that ultimately feeds back to the primary market: if people know they can resell a luxury or art item, they are more inclined to purchase it in the first place.

You’ve been at the forefront of discussions about art and tech with Artsy’s Art Genome Project. How do you view the intersection of tech and art, specifically with AI-generated pieces from models like DALL-E2?

I think artists are contributing the most interesting perspective on this issue. Whether it’s an artist like Refik Anadol, whose AI-generated work of art is currently on view in the MOMA lobby. The piece generates moving images of dreamt-up artworks based on the works in MOMA’s collection. He also exposes the code behind the images. The installation is massive– I see it as a new rumination on how we might interact with AI-generated art and how it might inhabit our spaces. If we think about the evolution of images, hundreds of years ago, it was hard to come by an image. Now, we are surrounded by them. Unsurprisingly, image makers haven’t kept up with our voracious appetite for more images, so we need AI to do that for us. But it doesn’t mean that all images are art. It just means that we will have more images around us all the time, fulfilling different functions than we can imagine today.